As the digital landscape continues to shape the way we handle money, peer-to-peer payment platforms like Venmo have become an integral part of modern financial interactions. While Venmo provides a convenient and efficient way to send and receive money, it’s important to understand the implications of using the platform for tax purposes. In this article, we’ll explore the relationship between venmo tax, shedding light on how transactions may need to be reported to relevant tax authorities.

Understanding Venmo Transactions and Personal

- Personal Transactions vs. Business Transactions:

- The distinction between personal and business transactions is crucial when it comes to taxes. Personal transactions, such as splitting a restaurant bill with friends, generally do not have tax implications.

- On the other hand, if you use Venmo for business-related transactions, such as selling goods or services, these activities may be subject to taxation. Business income is typically reportable and taxable.

- Income Reporting:

- If you receive payments through Venmo that constitute taxable income, you are responsible for reporting that income to the appropriate tax authorities, such as the Internal Revenue Service (IRS) in the United States.

- Freelancers, contractors, and individuals engaged in the gig economy who receive payments through Venmo for their services may need to report this income on their tax returns.

- Record Keeping:

- Maintaining accurate and organized records of your Venmo transactions is essential for tax compliance. This includes tracking income received and any associated expenses related to your business activities.

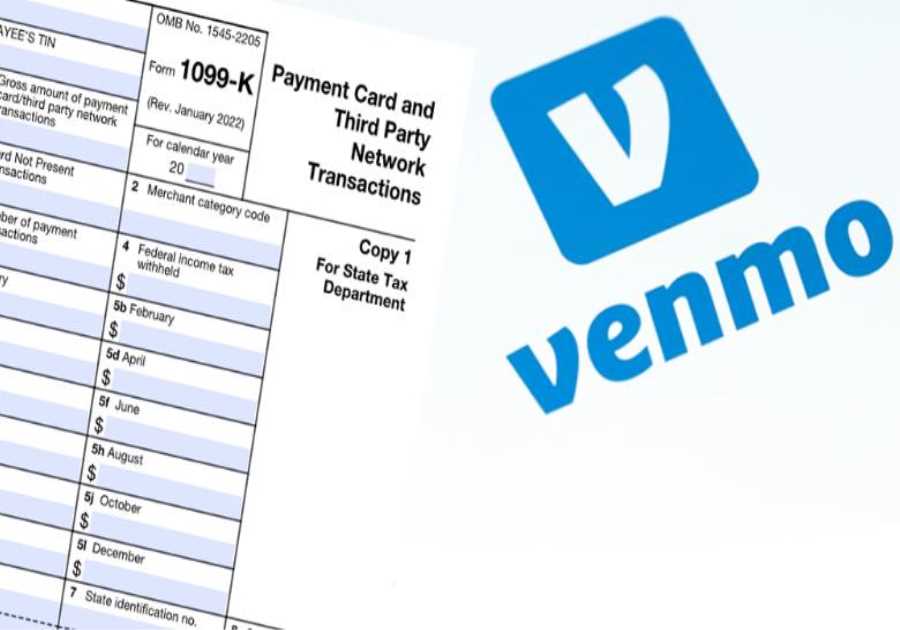

- Form 1099-K:

- In the United States, payment processors are required to issue Form 1099-K to individuals who meet certain income thresholds. Venmo will issue a Form 1099-K if you receive payments totaling $20,000 or more and have 200 or more transactions in a calendar year. This form is used to report income received through electronic payment transactions.

- Deductions and Expenses:

- If you use Venmo for business purposes, you may be eligible to deduct certain expenses related to your business activities. This could include expenses such as supplies, equipment, and operational costs. Consult a tax professional to determine which expenses are deductible.

Seeking Professional Advice

- Consult a Tax Professional:

- Tax laws and regulations vary by jurisdiction, and the tax implications of using Venmo can be complex. It’s advisable to consult a qualified tax professional who can provide guidance tailored to your specific situation.

- Educate Yourself:

- Familiarize yourself with tax laws in your country or region that pertain to digital payments and online income. Staying informed can help you make informed decisions and avoid potential tax pitfalls.

While Venmo offers a convenient way to manage personal finances and conduct transactions, it’s important to be aware of the potential tax implications, especially if you use the platform for business activities. By understanding the nuances of personal and business transactions, keeping accurate records, and seeking professional tax advice, you can navigate the relationship between Venmo and taxes with confidence and ensure compliance with relevant tax regulations.